Train Addiction Help Line: 1.866.840.7777

Sep 5, 2007 - N Scale

CP Rail to buy Dakota, Minnesota and Eastern for US$1.48B

CP Rail to buy Dakota, Minnesota and Eastern for US$1.48B

Deal is a big bet on the future demand for coal

Scott Deveau, Financial Post

Published: Wednesday, September 05, 2007Canadian Pacific Railway Ltd. said early this morning it will buy Dakota, Minnesota & Eastern Railroad Corp. for US$1.48-billion, betting big on global demand for coal.

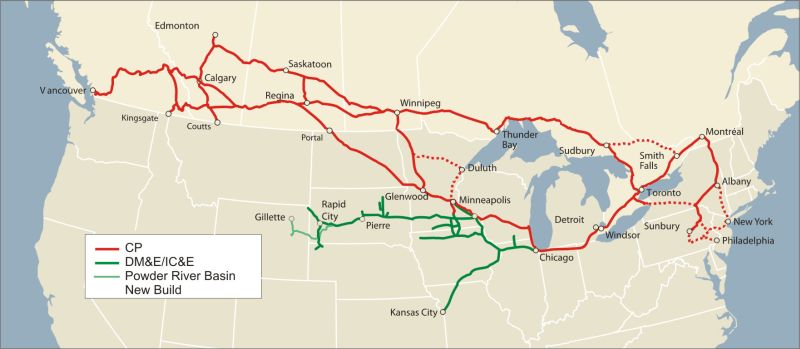

The deal, which is expected to close within 60 days, will expand the reach of Canada's second largest railway with the addition of more than 4,000 kilometres of track across the U.S. Midwest.

"DM&E is an excellent fit for Canadian Pacific making this a strategic end-to-end addition to our network," said Fred Green, CP's chief executive, in a statement today announcing the deal. "DM&E is a high-quality, growing regional railroad that complements our existing franchise."

CP said it may pay an additional $1-billion for DM&E. Of that, US$350-million is contingent on whether construction begins in the Powder River Basin coal project prior to Dec. 31, 2025. The remainder is contingent on whether a certain amount of coal is shipped out of the basin before that same date.

Immediate reaction to the deal was somewhat negative from the analyst community.

"We understand the attractive strategic benefits of this deal but we find the price tag to be somewhat high," said UBS analyst Fadi Chamoun in a note to clients, who said he would wait for more details from the conference call scheduled for 11 a.m. EDT.

DM&E received federal approval earlier this year to develop the coal-rich Powder River Basin, which is located on the border of Montana and Wyoming. But federal regulators later denied the railway's US$2.33-billion loan application in February to develop the region, prompting speculation that DM&E would become a possible target for acquisition.

The Powder River Basin project involves the construction of 451 kilometres of new rail line in the low-cost, low-sulphur coal region in Wyoming and the upgrade of nearly 965 kilometres of existing track in Minnesota and South Dakota.

Mr. Green said the investment provides an opportunity for future growth and will improve the railway's bottom line by 2008. He said CP will also invest an additional $300-million for further upgrades of DM&E to improve efficiency and safety in the coming years.

The transaction is subject to approval by the U.S. Surface Transportation Board. The regulatory approval is expected to take less than a year, during which time the shares of DM&E would be placed into an independent voting trust.

Due to the size of the transaction, CP also said on Wednesday that it has suspended a share buyback, in which it planned to buy back 10% of its outstanding shares for cancellation.

"With our strong balance sheet, this investment represents the best use of our free cash," said Mike Lambert, CP's chief financial officer.

The DM&E is headquartered in Sioux Falls, SD, and has approximately 1,000 employees, 4,000 kilometres of track and rolling stock that includes 7,200 rail cars and 150 locomotives. It serves eight states including, Illinois, Iowa, Minnesota, Missouri, Nebraska, South Dakota, Wisconsin and Wyoming with access to Chicago, Minneapolis/St. Paul, Kansas City and other key ports. Electra originally invested in DM&E over 20 years ago.

© Financial Post 2007